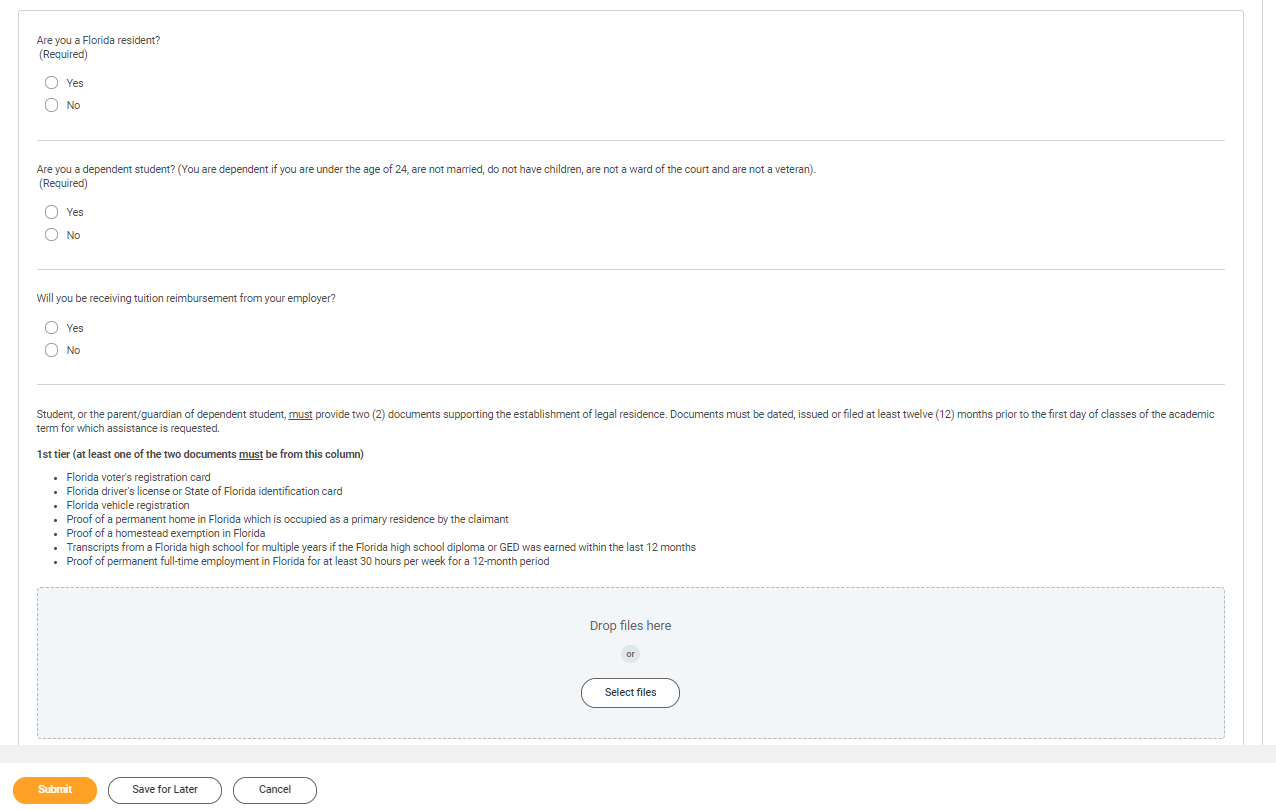

Complete this step to help Financial Aid staff determine your state residency status for financial aid purposes.

| Complete Questionnaire. If Florida resident, you will need additional documentation to apply for the Florida EASE Grant Application: Student, or the parent/guardian of dependent student, must provide two (2) documents supporting the establishment of legal residence. Documents must be dated, issued or filed at least twelve (12) months prior to the first day of classes of the academic term for which assistance is requested. 1st tier (at least one of the two documents must be from this column) - Florida voter's registration card

- Florida driver's license or State of Florida identification card

- Florida vehicle registration

- Proof of a permanent home in Florida which is occupied as a primary residence by the claimant

- Proof of a homestead exemption in Florida

- Transcripts from a Florida high school for multiple years if the Florida high school diploma or GED was earned within the last 12 months

- Proof of permanent full-time employment in Florida for at least 30 hours per week for a 12-month period

2nd tier (may be used in conjunction with one document from the 1st tier) - Declaration of domicile in Florida

- Florida professional or occupational license

- Florida incorporation

- Documents evidencing family ties in Florida

- Proof of membership in a Florida-based charitable or professional organization

- Utility bills and proof of 12 consecutive months of payments

- Lease agreement and proof of 12 consecutive months of payments

- Official state, federal or court document evidencing legal ties to Florida

Need Help? Contact Financial Aid +1 561-237-7185| financialaid@lynn.edu

|