...

The 1098T form is prepared every January to report to the IRS how much tuition you paid for the previous tax year, and how much you received in scholarships, if applicable. This is a consent to receive your 1098T form electronically.

| Expand |

|---|

|

| Expand |

|---|

| title | Click here for description... |

|---|

|

Description | To Do |

|---|

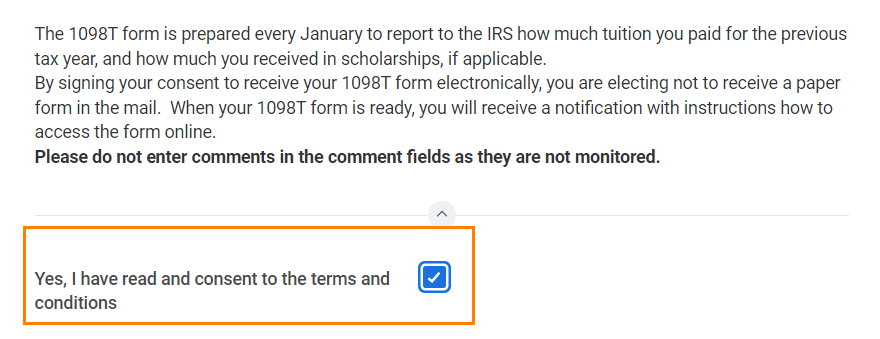

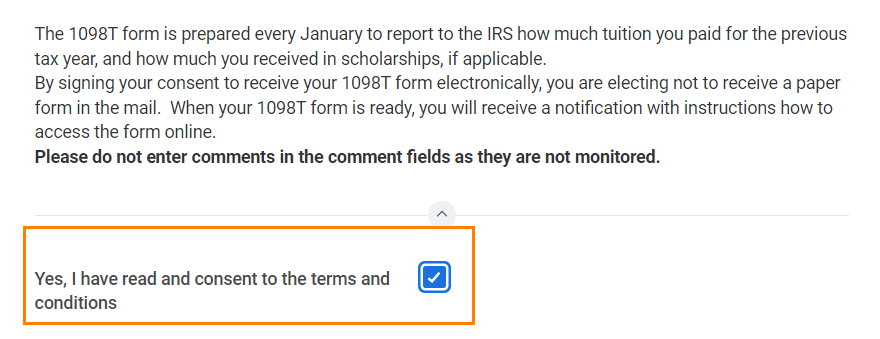

The 1098T form is prepared every January to report to the IRS how much tuition you paid for the previous tax year, and how much you received in scholarships, if applicable. |

|---|

By signing your consent to receive your 1098T form electronically, you are electing not to receive a paper form in the mail. When your 1098T form is ready, you will receive a notification with instructions how to access the form in Workday. Need Help? Contact Student Financials +1 561-237-7504 | studentaccounts@lynn.edu |

|

- ClickontheConsenttoReceiveForm1098-TElectronicallytask.

- Click the checkbox to the right of Yes, I have read and consent to the terms and conditions.

Consent checkmark

Consent checkmark

- ClickSubmit. Click Done.

...